Investing in stocks has never been easier for retail traders thanks to inventions like smartphones and mobile apps. If you have an iPhone, you can start building a diversified stock portfolio in as little as a few minutes. Before you can buy any stocks, you’ll need to install a brokerage application like Robinhood, which requires specific personal data and a funding source. Read on to learn more about how to buy stocks on an iPhone.

Steps to Buy Stocks on an iPhone

Here are the essential steps to buy stocks on your iPhone.

Step 1: Choose a Brokerage App

The Apple App Store is chock-full of investment brokerage apps, ranging from legacy firms to startups. Online brokerages have a wide range of offerings too. Some offer asset management and tailored financial services, while others offer a simplified trading experience with few bells and whistles.

How do you choose an investment broker? The answer depends on your goals as an investor. If you’re an advanced trader looking to employ technical analysis and complex investment strategies, you'll want a broker with sufficiently detailed charting tools and advanced order types. But if you lack experience as a trader and want to learn how the stock market works, you might prefer a broker with basic investment funds and helpful customer service.

- Robinhood is a mobile-first platform with an intuitive interface known for being one of the first to offer commission-free stock, ETF and options trades. However, Robinhood may have limitations on features and account types compared to other brokers. It is also lacking in educational content and chart tools.

- E*TRADE is an established online broker with a user-friendly platform and a wide range of account types and tradable assets. It offers commission-free stock and ETF trades, plus research tools and educational resources from reputable investment news sources.

- Fidelity is a large, well-respected brokerage known for its comprehensive investment options, including managed portfolio services and zero-fee ETFs and mutual funds. Stocks and ETFs trade commission-free and the low-cost index funds make Fidelity a popular choice for long-term investors. The firm has extensive research tools, educational resources and a strong customer service reputation.

One factor you won’t need to consider is stock and ETF commissions. Thankfully, most online stock brokers have gone commission-free on basic assets like stocks, but you’ll still need to compare commissions and fees on assets like options, bonds, mutual funds and futures contracts if you want to trade those securities. Also, consider the features of the trading app platform, access to different account types like IRAs, and the availability of research and market news sources.

For the purposes of this article, we’ll use Fidelity as our example since it's a well-rounded brokerage service with an easy-to-learn mobile app and plenty of investment options.

- Best For:Active and Global TradersVIEW PROS & CONS:Securely through Interactive Brokers’ website

- Best For:Active Short Sellers With Modest CapitalVIEW PROS & CONS:securely through TradeZero's website

Step 2: Download and Install the App

To download the Fidelity Investments mobile app, navigate to the Apple App Store and search for it. Always use the official App Store to download new programs, and never trust an unverified link from an email or social media.

Open the App Store app and type ‘Fidelity Investments’ (or whichever broker you’ve selected) into the search bar. Some companies like Fidelity have more than one app for their various services, such as online banking or workplace benefit management. Make sure the app you download is specifically titled Fidelity Investments; it’ll be the one with the most reviews.

Tap on the Fidelity Investments icon and click Download (or Open if you already have it). This will start the download process, and you can create an account right from your iPhone in just a few minutes. Note that you’ll be submitting personal data to open your account, so always ensure you’re connected to a protected Wi-Fi channel when downloading apps and signing up for new services.

Step 3: Create an Account

Now that you have a stock trading app on your iPhone, register and verify your account. But remember, not every brokerage account is the same. Margin accounts can trade with borrowed money, and retirement accounts like IRAs have tax benefits depending on your income and contribution level. Consider your account options and select the one that best suits your investment needs.

Account Registration

If you don’t already have an account with Fidelity, you’ll need to use your web browser to visit the company’s website and initiate the account registration process. But if you already have a login and password for Fidelity’s mobile platform, you can open new accounts directly from the app.

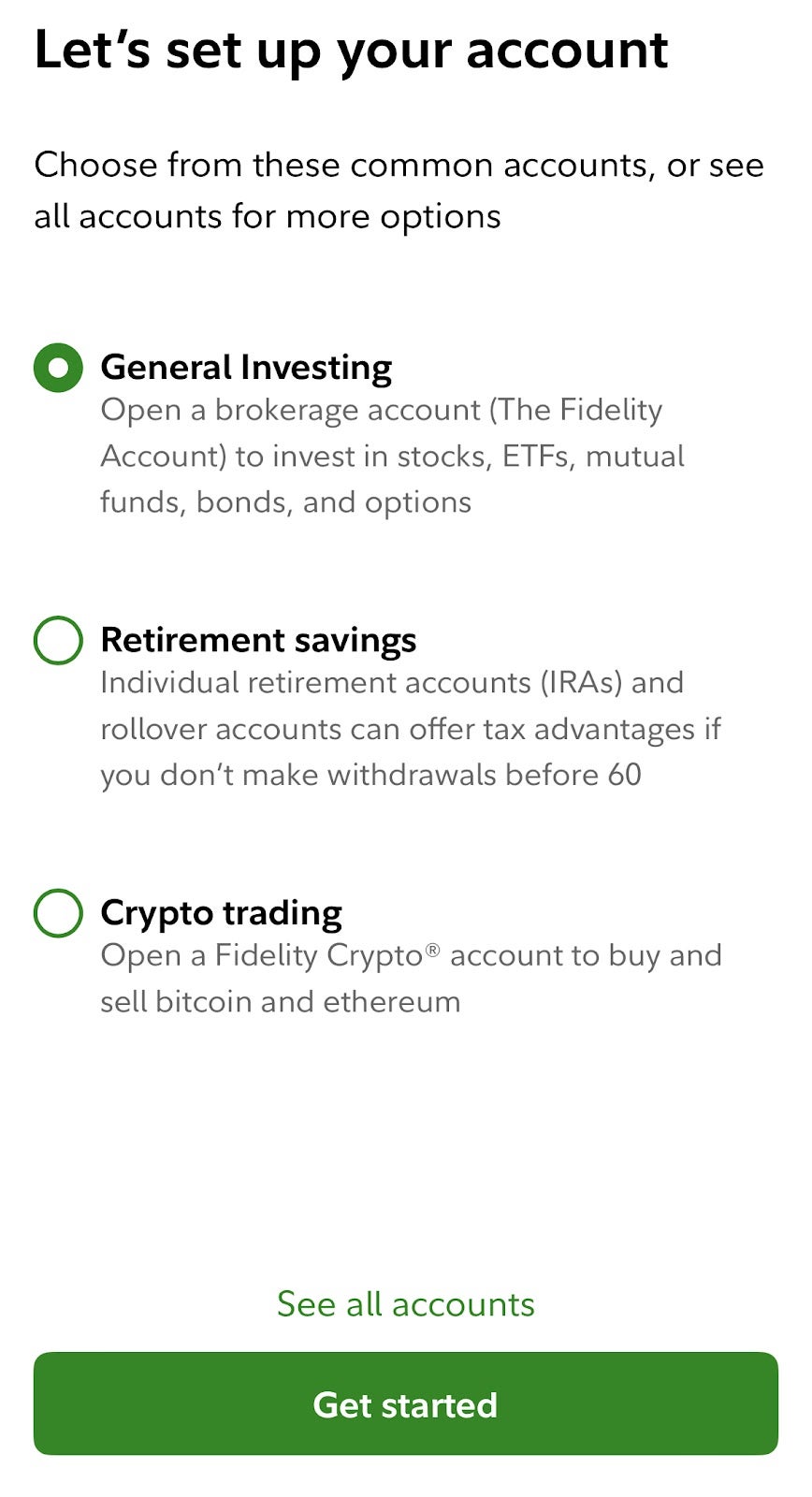

First, you’ll need to pick an account. The standard account is a taxable brokerage account, but you can also select from traditional IRAs, Roth IRAs, 529 accounts, custodial accounts and a wide range of managed portfolios. Once you’ve selected the one you wish to open, you must enter some personal data to verify your identity.

Have the following documents ready:

- Government ID (driver's license, passport, military ID)

- Social Security card

- Bank account information (for depositing funds)

If you want to use advanced investment strategies like options or margin, you may need more information, such as employment info, annual income, and proof of residence. Once you’ve submitted the necessary information, you can create a username and password for the mobile app and begin funding your account immediately.

Account Verification

The account verification process varies depending on the type of account you want to open. For standard accounts like cash, margin or IRAs, you’ll be able to start funding your account and trading within minutes.

However, if you want to open a less common account type like a managed portfolio, inherited IRA or 529 plan, you’ll likely need additional documents beyond a government ID, Social Security card, and bank statement.

Step 4: Fund Your Account

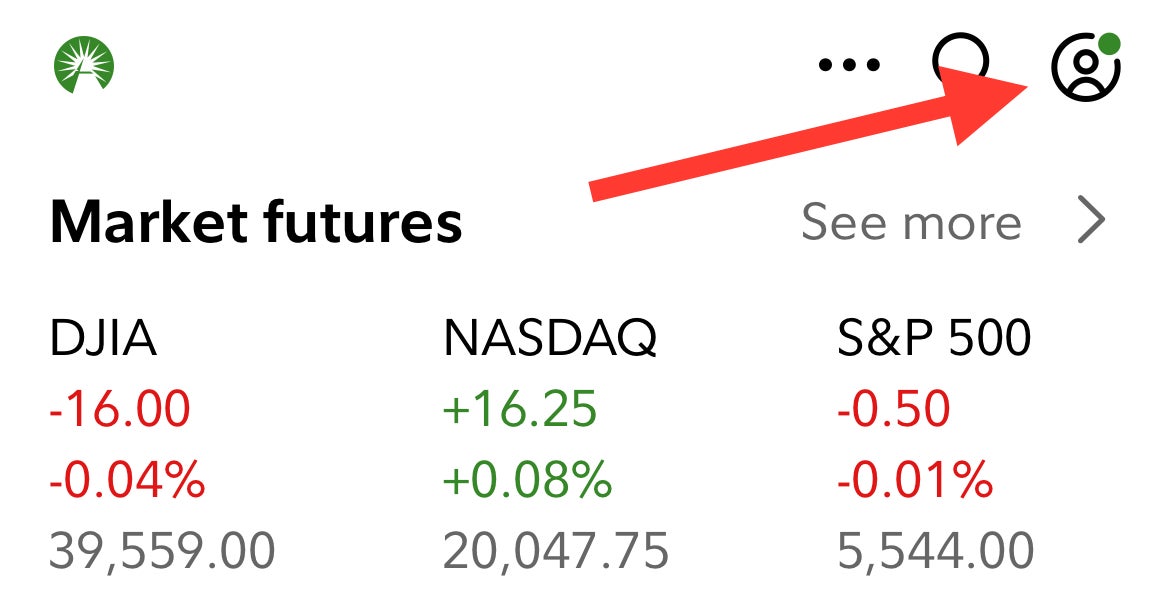

Once your identity is verified and your account is open, you can fund your trading through a linked bank account. Open the mobile trading app on your iPhone and log in using your username and password. Select the account you wish to fund and tap the Profile icon in the upper right-hand corner of the app.

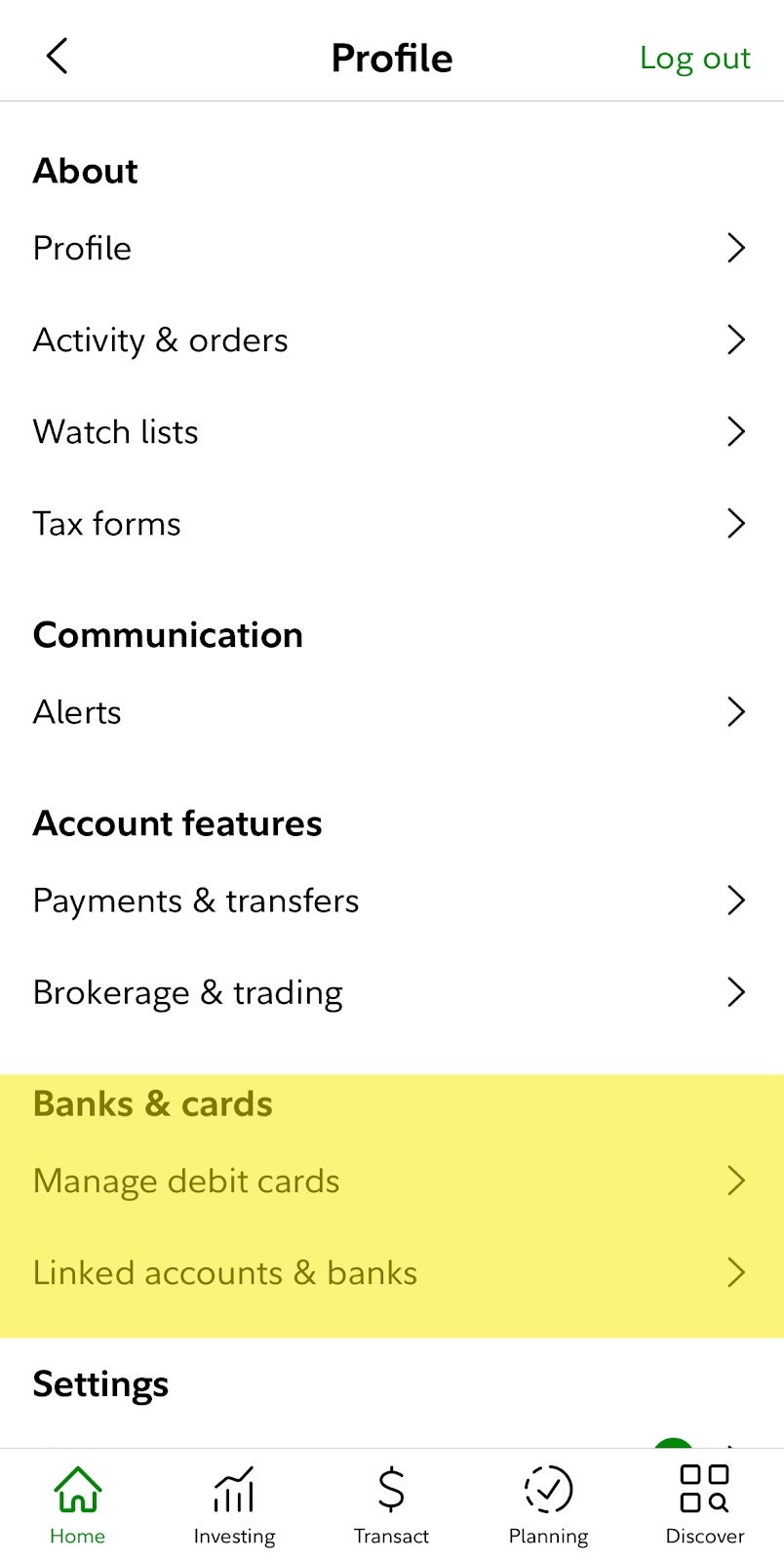

From the Profile screen, you can view your trading history, change your personal information and beneficiary, access tax forms, set up the platform and add funds from a linked account. Under the Banks & Cards heading, tap either Manage Debit Cards or Linked Accounts and Banks.

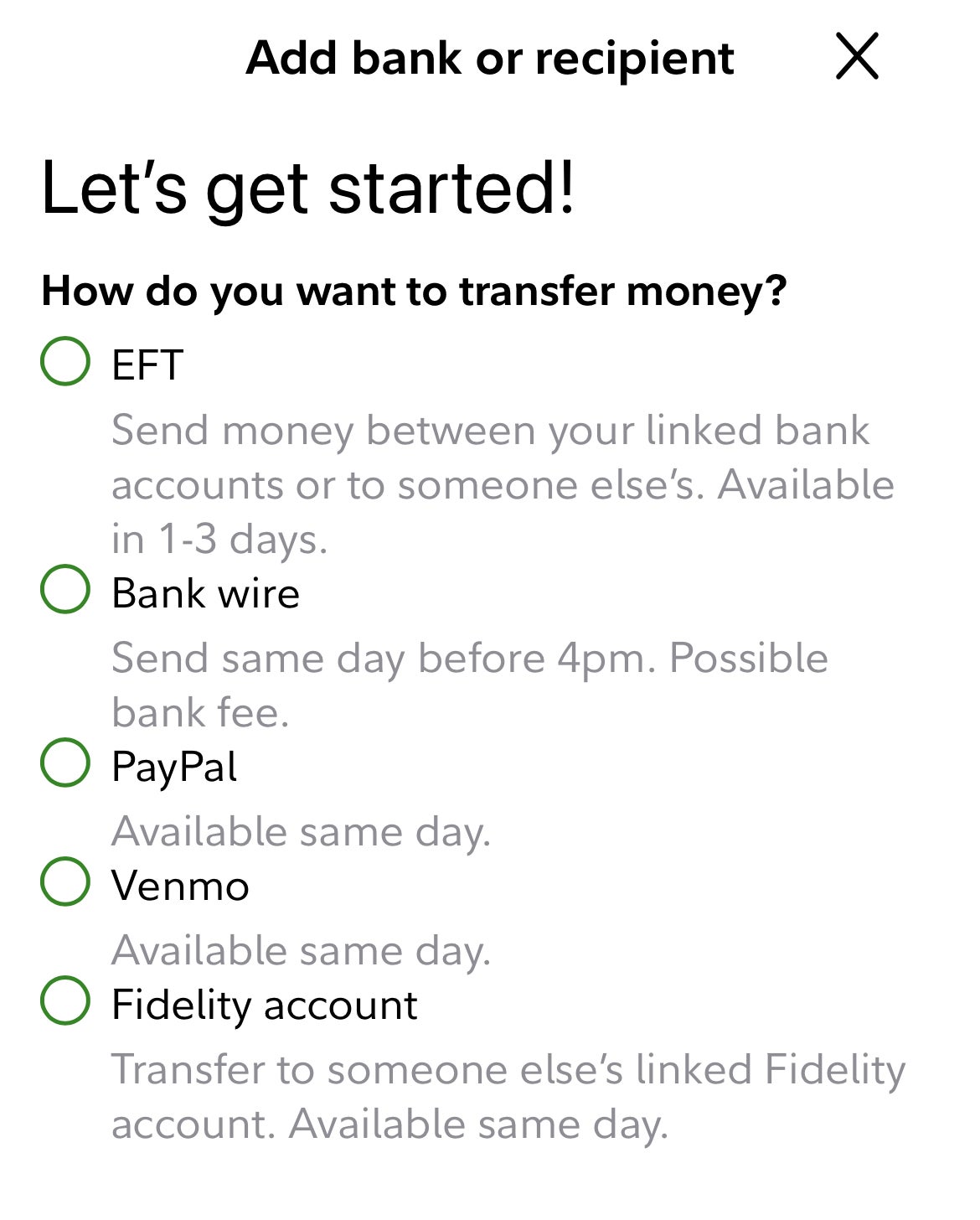

Tap on Linked Accounts and Banks, then tap Add at the bottom of the following screen. You’ll be asked how you want to transfer money from the following choices:

Certain transfers will be available the same day for instant trading, but some wire transfers and EFT transfers may take additional time (banks often charge fees for wire transfers). You can transfer as little as $1 to a Fidelity brokerage account, but you’ll probably want a larger capital base to start investing.

Step 5: Search for Stocks

After you’ve built your capital base, it's time to implement your investment plan. If you’ve already researched stocks and know what type of portfolio you want to build, you can start looking for those securities on the app. But if you don’t have a plan, take some time to create an investment blueprint and map out your goals and timeline.

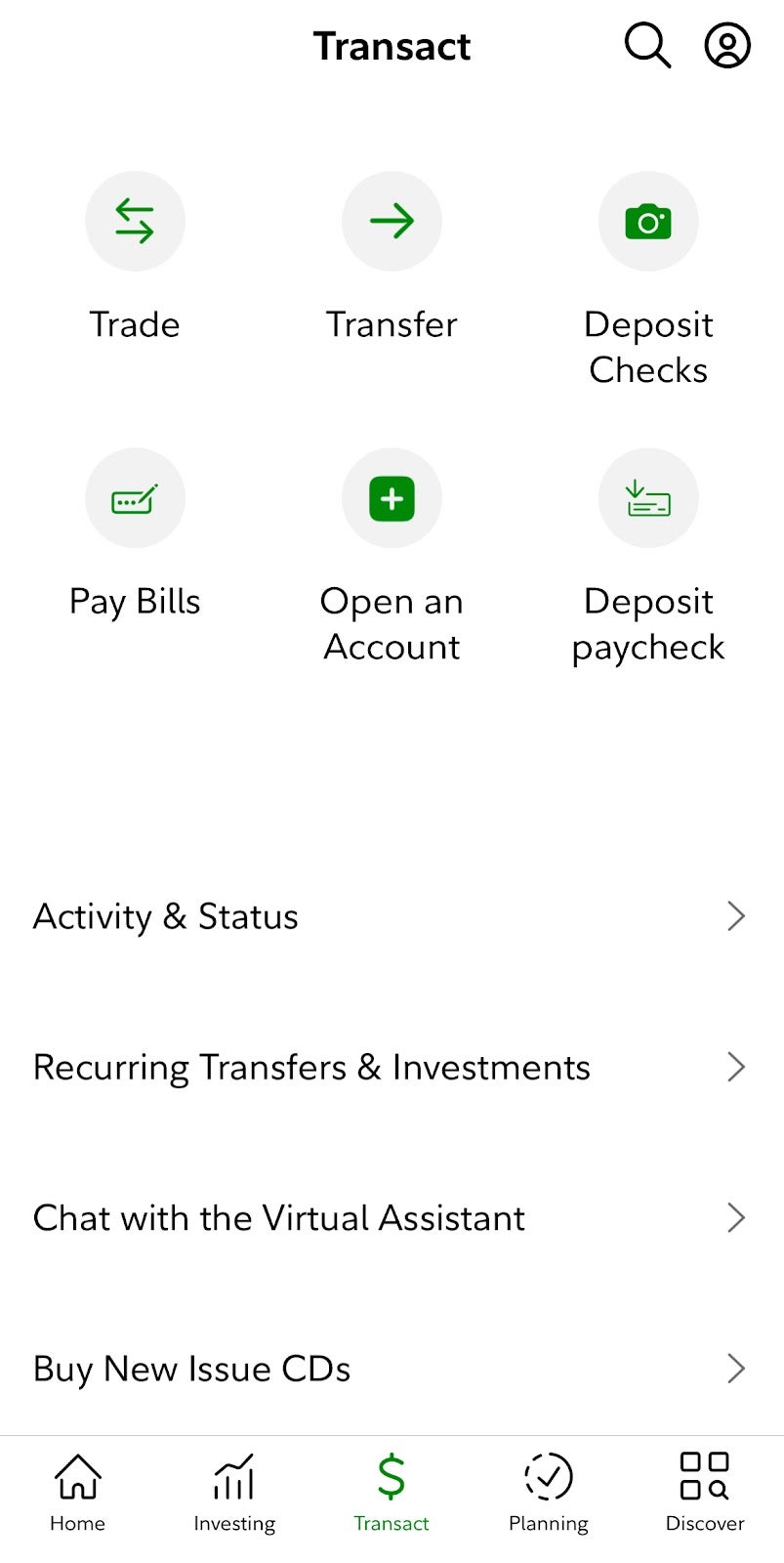

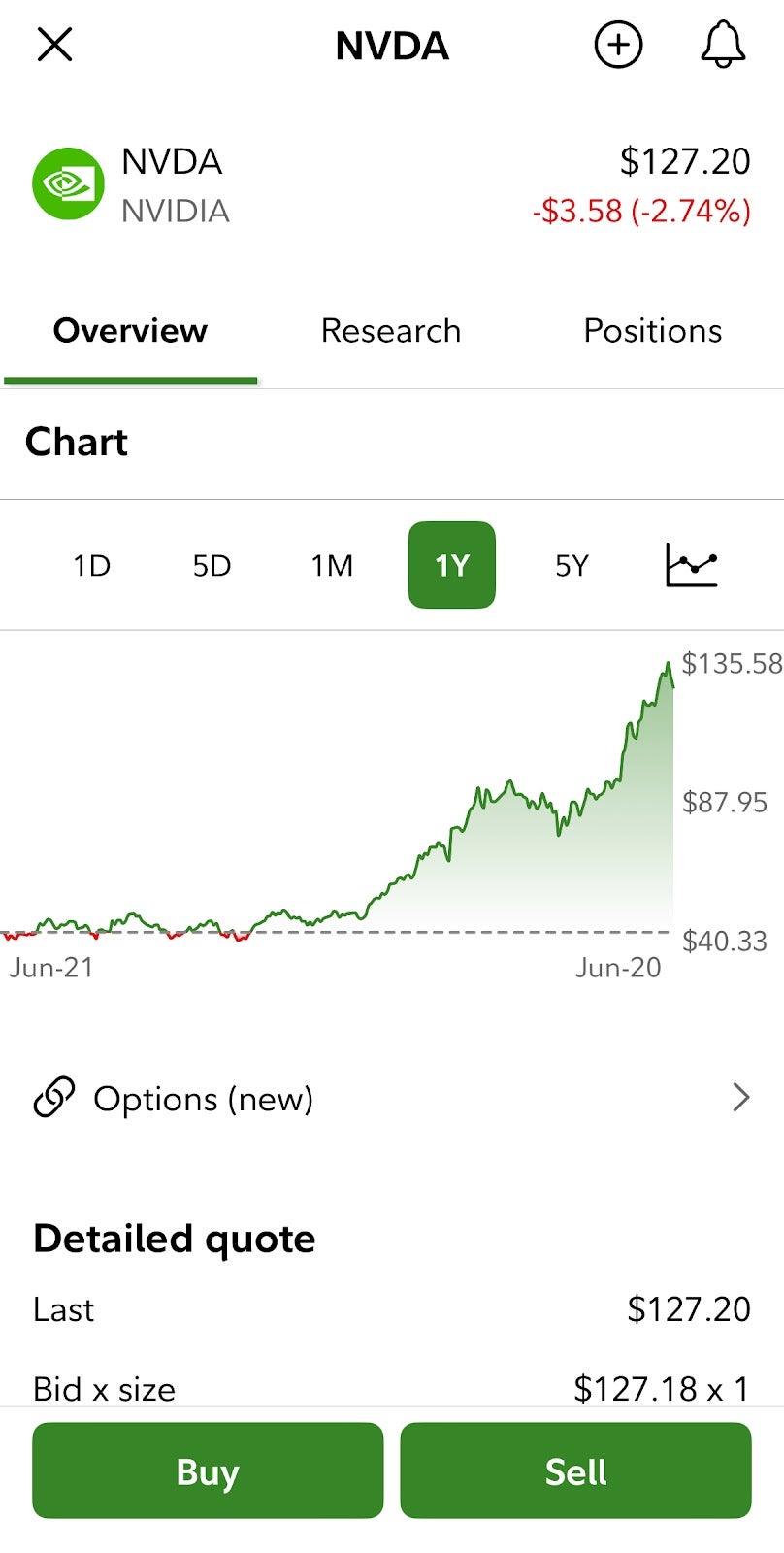

To search for a stock, tap on the Search icon and enter the ticker symbol of the stock you want to buy. Alternatively, tap the Transact icon at the bottom of the app and then tap Trade. You can enter ticker symbols manually or select from a list of recent quotes. Select your desired stock and move to that company’s stock chart page.

From here, tap on the Buy icon in the lower left hand corner, and you can place your order for shares on the next screen.

Step 6: Place an Order

Investors have plenty of complex order types for activities like day trading or derivatives trading, but for this exercise, you’ll only need to be concerned with two different order types:

- Market orders

- Limit orders

A market order will place a buy request and execute it as quickly as possible at the best available market price. On the other hand, a limit order has a preset activation price. If a limit order is placed, the buyer must set a ‘limit price’ at which the order will activate and purchase the shares. Limit orders give investors the opportunity to place stock orders and wait for an ideal price to be reached before execution.

Step 7: Confirm the Purchase

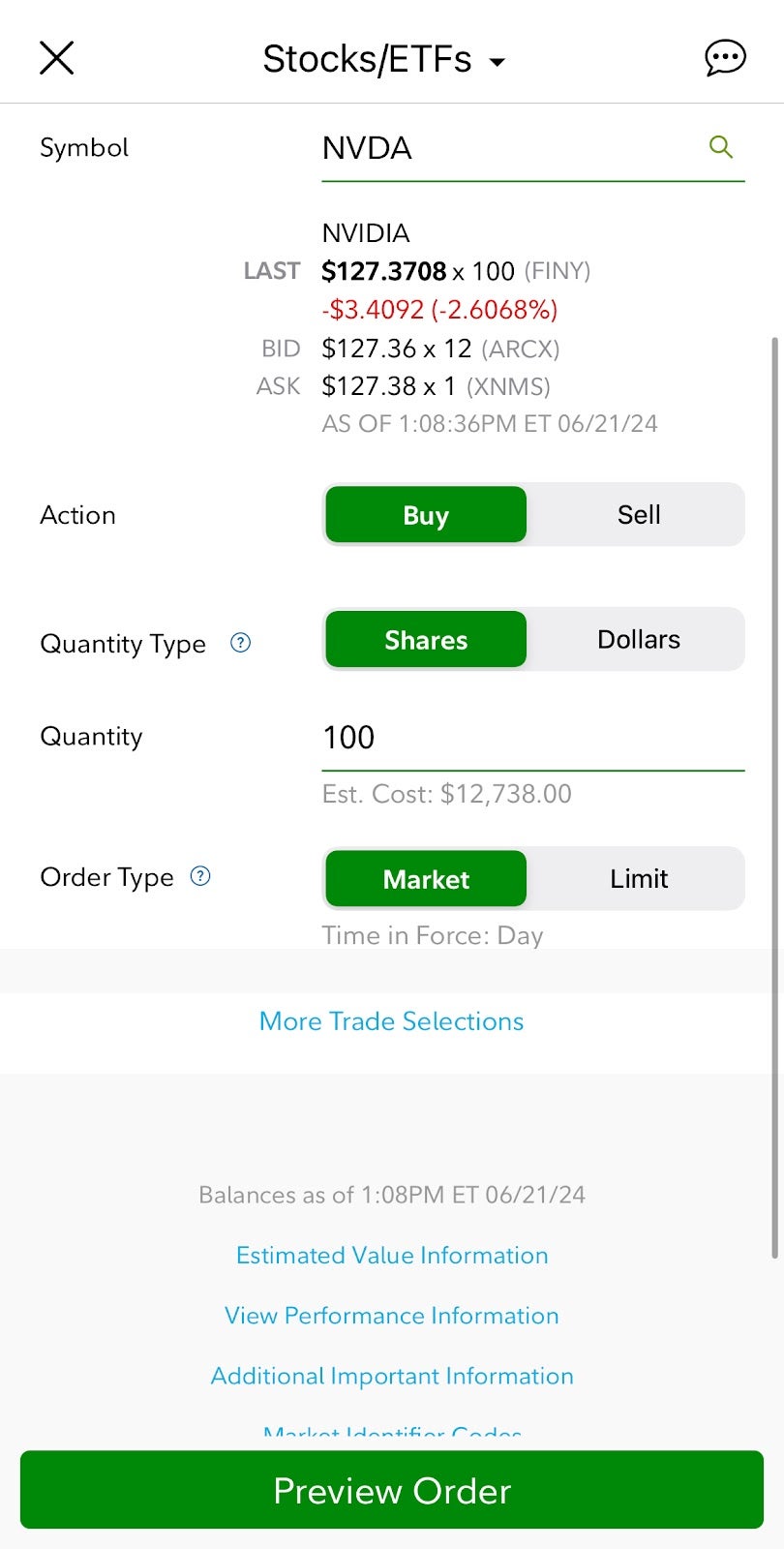

On the Buy screen, select the trade action you wish to take, the number of shares you want to buy, and the type of order you want to use for the transaction. If you want to buy 100 shares of NVDA:

- Make sure Buy is highlighted

- Make sure Shares are highlighted (and not Dollars)

- Type 100 into the Quantity box

- Choose Market or Limit order

- Tap Preview Order

Double-check your order on the Preview screen and make sure you have the proper account, investment value and order type selected. If all the information is correct, you can submit your order and wait for execution. If you used a Market order, you’ll be able to see the shares in your account almost immediately.

Step 8: Monitor Your Investments

Like a garden, your investment portfolio needs attention and care to grow. Once your portfolio is built, your investment plan comes into focus: What are your holding period timelines? What stocks will you buy more of if they decline? What stocks will you sell for quick profits, and which will you hold for the long term? Make sure you know how you’ll respond to market volatility or economic turbulence before it happens.

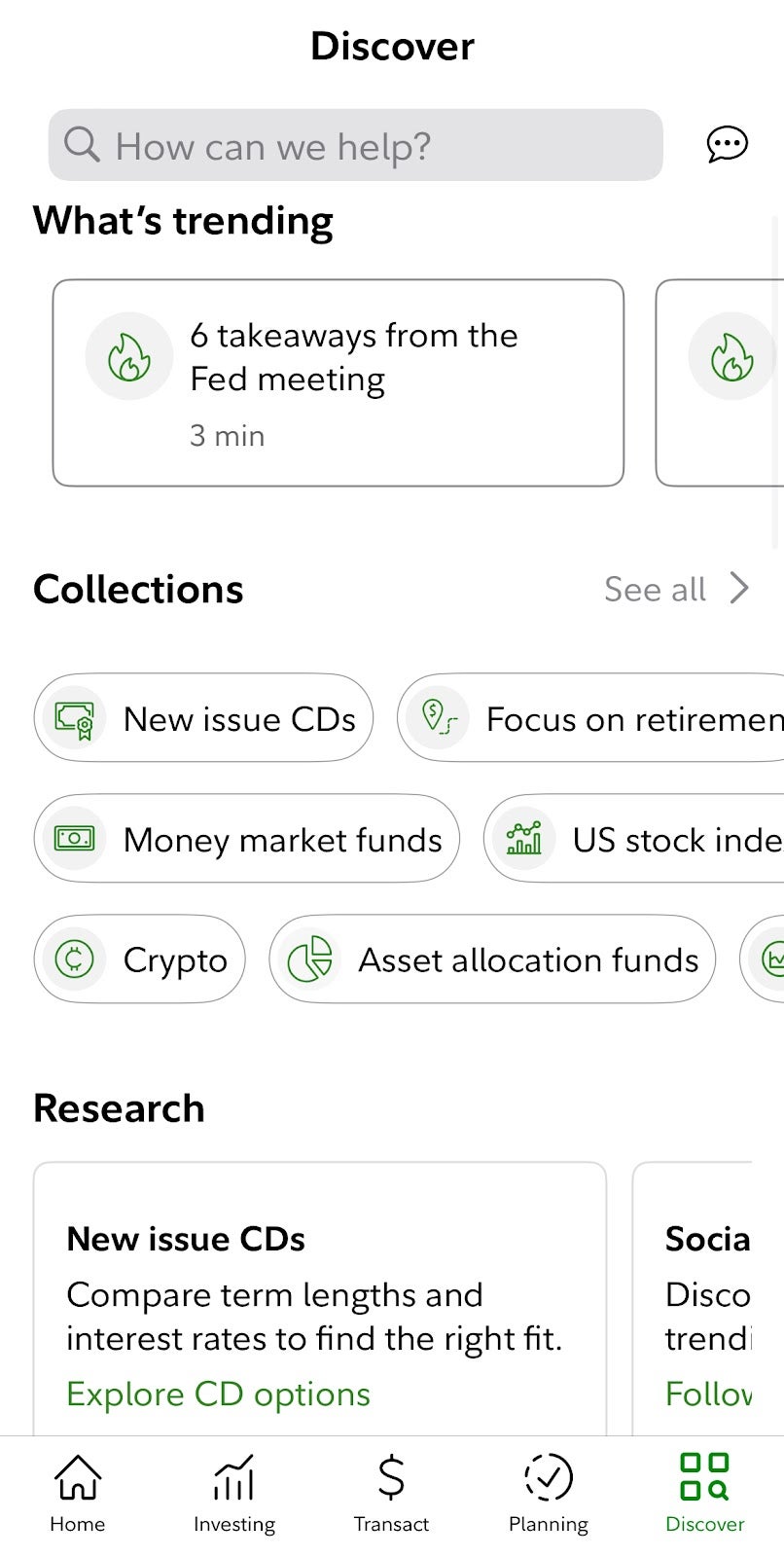

Use your brokerage app to monitor your stock portfolio, market trends, earnings reports and economic data. Fidelity brokerage app users can access market information through the Discover tab, which displays trending stocks, news and stock research, different sectors and asset classes, bond and CD rates and videos from market experts. From here, you can research strategies like diversification and get the latest market news and data.

Can You Buy Stocks on the Apple Stocks App?

The Apple Stocks app can be a useful tool for tracking investments, but you cannot directly buy stocks on it. While the Stocks app allows you to view quotes, charts and news related to various stocks and other financial instruments, it doesn't have built-in functionality for buying or selling securities.

What does the Apple Stocks app have? You can create watchlists to track the performance of any stocks, indexes, ETFs and currencies or simply keep an eye on your own stock portfolio. Search for stocks by sector, market capitalization or other factors. The Stocks app has interactive charts that can be adjusted based on your investment style, along with financial news headlines from any publication covered on Apple News.

Frequently Asked Questions

Can you buy stocks on an iPhone?

Yes, you can buy stocks on your iPhone, but you must download a brokerage app. You can choose from mobile-only brokers like Robinhood and TradingView or legacy firms like Fidelity or Charles Schwab.

How to set up stocks on iPhone?

The Apple Stocks app is easy to integrate into your iPhone menu screen. However, if you want an actual stock trading app, you must download an app from a brokerage firm.

How do I start trading on my iPhone?

To trade stocks on an iPhone, you must sign up for a brokerage account and download the app. You’ll need personal data like a driver’s license and Social Security card, plus a linked bank account from which you can deposit cash for investing.

About Dan Schmidt

Dan Schmidt is a finance writer passionate about helping readers understand how assets and markets work. He has over six years of writing experience, focused on stocks. His work has been published by Vanguard, Capital One, PenFed Credit Union, MarketBeat, and Fora Financial. Dan lives in Bucks County, PA with his wife and enjoys summers at Citizens Bank Park cheering on the Phillies.